Call it the “halving”, “halvening”, or whatever floats your boat, but in one year’s time, Bitcoin (BTC) investors are going to experience a monumental event.

By this time next year — if current estimates are accurate that is — the number of BTC issued each block will fall from 12.5 to 6.25, a reduction of 50%. With this, Bitcoin’s inflation falls in half and falls under the Federal Reserve’s 2% target for the U.S. dollar. Some are sure that this simple dynamic will catalyze a big bout of growth in the cryptocurrency market.

The Impending Halving

The inflation of most assets can be hard to predict. Just look at the Venezuelan Bolivar as a perfect case in point. As Blockonomi reminded readers in a report on Venezuela and crypto-centric charity, if digital assets are built correctly, consumer users of said asset should be able to predict future inflation rates to a tee.

As Kyle Samani of Multicoin Capital explains about Bitcoin:

“The first halvening brought inflation from 40% to 20%. The second from 20% to 10%. The next halvening is going to reduce it from about 3.8% to 1.9%.”

So we can determine what the inflation of Bitcoin will be in ten years, but not the U.S. dollar. For all we know and as some cynics speculate, something like the U.S. dollar may be subject to hyperinflation by the next decade, as a result of fiscal irresponsibility and mismanagement.

This, coupled with the simple laws of supply and demand, have led many in the industry to suggest that the next halving will be entirely bullish for the Bitcoin price. In fact, Bloomberg reports that in a recent Twitter poll, 61% of some 2,500 users believed that BTC will rally into May 2020 and afterward, citing supply and demand economics to back their cheery expectations.

As Tuur Demeester of Adamant Capital points out, Bitcoin’s historical halvings have always kicked off bull markets, acting as milestones in the asset’s cycles.

Halvening centric perspective on Bitcoin price. H/T @StoicTrader_ & @MLescrauwaet pic.twitter.com/89trRlSOqd

— Tuur Demeester (@TuurDemeester) May 16, 2019

Where Could Bitcoin Head Exactly?

But how high will Bitcoin head after the halving? According to models created by PlanB, a popular Bitcoin-centric statistician, the next halving will result in BTC moving much higher than it did in 2017’s rally.

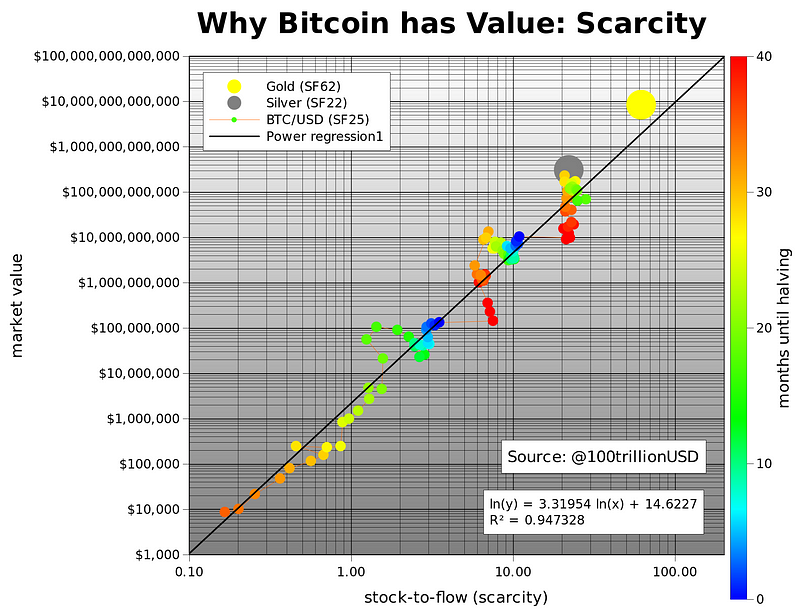

PlanB recently determined that the SF ratio of an asset is linked to its market capitalization. As can be seen in the image below, the higher the SF ratio, the higher the value of the asset. The thing is, the correlation between the SF ratio and price is logarithmic.

As it stands, Bitcoin’s current SF ratio is approximately 25, making it understandable that it is valued around the same as silver, which has an SF ratio of 22. With the next halving though, Bitcoin’s SF ratio will begin to approach gold’s SF ratio of 55.

More specifically, BTC’s SF ratio will double from 25 to 50. The model states that Bitcoin hitting a $1 trillion market capitalization after 2020’s halving event, which translates to approximately $55,000 per coin, is entirely possible.

While $55,000 for each BTC seems irrational, PlanB concludes by writing that money from silver, gold, negative interest rate economies, authoritarian and capital control-rife states, billionaires looking for a quantitative easing hedge, and institutional investors will eventually flood into this space.

Some Beg To Differ

Some have been a bit skeptical of this, however. Speaking to Bloomberg, Eric Turner, the director of research at Messari, reminds readers that those relating halvings to price booms are using a sample size of two, making it “hard to assign any statistical significance to the event”. Gil Luria, managing director at DA Davidson & Co., echoed this sentiment, stating:

“Since halving events are known well in advance, it is unlikely that they would have any impact on the price of Bitcoin. There are so many factors that impact the price of Bitcoin, but this should not be one of them.”

Regardless, most seem to be under the impression that in the long run, Bitcoin is going to do just fine.