Despite the stellar growth Bitcoin has seen over the past decade, it is still a small asset on the stage of global finance. For some perspective, the cryptocurrency’s market capitalization clocks in at $187 billion. This is less than one-fifth of Apple’s market capitalization.

While $187 billion is obviously nothing to sneeze at, a majority of individuals involved in the industry are sure that Bitcoin’s long-term growth cycle has not run its course yet. In fact, one model predicts that by 2025, Bitcoin will have appreciated by around five times from the current price level of $10,500.

A $1 Trillion Bitcoin Network

For years now, price milestones have been a staple of the Bitcoin community. While Bitcoin is evidently anti-fiat, the community has made a habit of denominating milestones in U.S. dollars, presumably to show its progress in overtaking traditional finance.

In 2013, Bitcoin’s market capitalization surmounted $1 billion and $10 billion; in late-October of 2017, the same metric passed $100 billion. According to Bytetree, the next time Bitcoin’s network value reaches a new order of magnitude will be in 2025 — some six years away.

Analyst Charlie Morris wrote in the note that using a logarithmic chart, we can observe that for most of its life, Bitcoin has had an internal rate of return (IRR) of 212% per annum, which means that each year, investors have trebled their capital. However, this changed in the bear market of 2018, which resulted in Bitcoin losing the trend line due to overwhelming sell pressure and the absolute absurdity of a 212% compounding yearly growth rate ($100 would turn into $8.7 million after a decade).

While Bitcoin losing a nine-year-long trend seems harrowing, Morris goes on to point out that Bitcoin has entered into a new trend, one defined by an IRR line of 115% per annum. As seen in Bytetree’s chart below, Bitcoin has traded around that line on multiple occasions, accentuating its importance.

Should this trend continue, the analyst writes, Bitcoin could “touch a trillion dollars by 2025”, which equates to around $50,000 per coin.

What Will Drive BTC?

While the $1 trillion figure seems entirely arbitrary, something plucked out of the air to appease optimistic cryptocurrency investors, prominent investors, economists, and analysts have concluded that Bitcoin is likely to only see demand increase dramatically in the coming years.

Adam Back, the creator of a Proof of Work protocol that was built on for Bitcoin, recently laid out a number of reasons why Bitcoin appreciating to $50,000 and a market cap of $1 trillion isn’t a “far off” theory. Back’s expected catalysts for Bitcoin growth include the copious amount of geopolitical uncertainty, best exemplified by the U.S.-China trade war, protests the world over, and populist political movements; the existence of $17 trillion worth of negative-yielding bonds, which don’t abide by any traditional economic standards; and the adoption of Modern Monetary Theory, an economic framework that its critics say will lead to mass inflation.

Bring it on, 2020 halvening, lots of geopolitical uncertainty, $15tril of -ve interest bonds, MMT excuses being tested to bring an even more imprudent USD inflation regime.

With a $50k BTCUSD price, $1tril market cap, would be as @TuurDemeester says not far off 🙂 https://t.co/Re9EOW9js5

— Adam Back (@adam3us) September 6, 2019

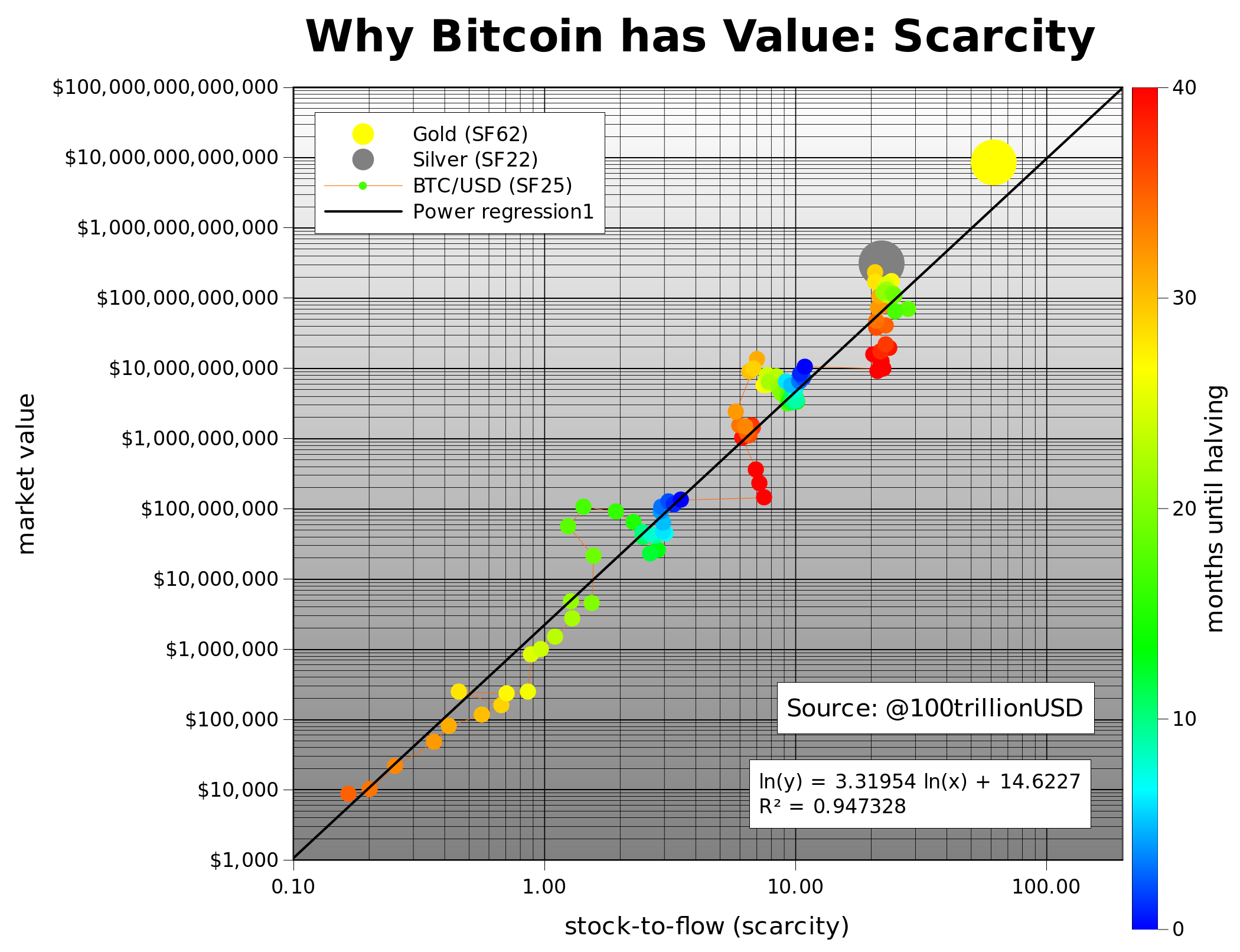

Back isn’t the only one eyeing a lofty $50,000 price target for Bitcoin. A model from prominent Twitter statistician PlanB, a pseudonymous quantitative analyst that hails from traditional markets, shows that BTC’s fair market capitalization will swell to $1 trillion after the May 2020 block reward reduction.

The model states that certain commodities, namely gold, silver, and BTC, can be valued by taking their stock-to-flow (SF) ratios — an asset’s above-ground supply over its yearly inflation — and plotting them on a certain linear regression line.

PlanB’s model predicts that come next May, Bitcoin’s SF ratio will begin to approach that of gold, which is currently at 55, meaning that its fair value should too.