Back in the day, acquiring Bitcoin with a debit or credit card used to be extremely challenging; even tech-savvy individuals experienced great difficulties with acquiring the lucrative cryptocurrency.

Thankfully, a lot of reputable and trusted exchange platforms are now available, like eToro, Binance, Coinbase and CoinMama. These exchanges allow for bitcoins to easily be purchased with credit or debit cards.

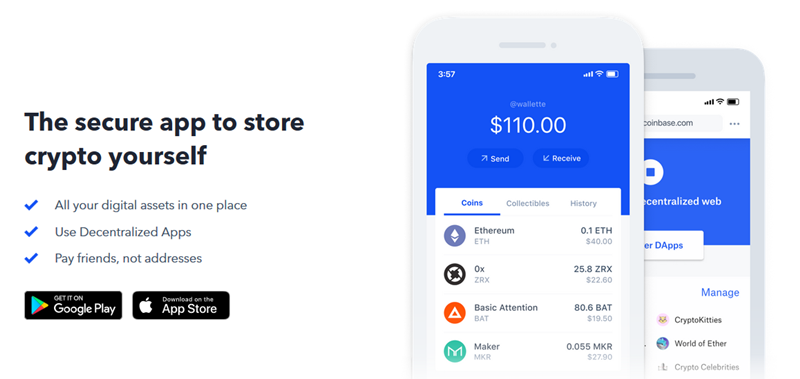

Individuals will need to create a bitcoin wallet before they can utilize the full potential of bitcoin exchanges. Wallets are quite easy to make and can be stored on a phone, on a computer, online, or in a physical way, such as a piece of paper or some sort of cold storage method.

Another thing to bare in mind when purchasing your bitcoin, is the fees that the exchange will charge yon each transaction – make sure you look at what the charges will be and compare them across the exchanges we have listed below to be sure of getting the best deal with your bitcoin purchase.

In this post we have put together a list of the most reputable online exchanges for purchasing bitcoin using your debit or credit card. There are also crypto-only exchanges that could be a better fit for crypto traders. While it is relatively harder to transfer your fiat currency into cryptos, making the jump from one crypto exchange to another is simple.

The are numerous crypto exchanges out there will all offer something different to their clients. No matter what you want to do in the world of cryptocurrencies, this post will help you find the right tools for the job!

Where to Buy Bitcoin With Card Or Bank Transfer

If you are sitting on some fiat currency that you want to turn into Bitcoin, there are loads of options out there. Make sure to consider a bank transfer as well, and they can be cheaper in some cases.

There are also restrictions on some countries when it comes to buying cryptos with credit and debt cards, so don’t walk away from an exchange you like before you make sure they won’t accept a bank transfer.

- Coinbase: Highly Regarded and Easy to Use for Beginners

- eToro: Easy to Use Platform

- Binance: Largest Crypto Exchange with Low Fees

- FTX: Great Exchange for Newbies & Advanced Users

Visit The Top Pick

Coinbase: Our Top Pick & Easiest Method

Coinbase is the globe’s largest exchange platform. Currently, the platform is fully functional in the United States, Canada, Europe, the United Kingdom, Australia, and Singapore.

The platform allows users to instantly purchase bitcoins with a credit or debit card. You simply need to create an account on the platform, confirm some personal details, and log in.

Coinbase may be one of the best choices for people that live in the US, as they are up to date on all the tax laws that US citizens and residents need to follow. Some users were upset that Coinbase shared all its clients’ trading history with US tax authorities, but this is necessary for any company that wants to interact with the US financial system.

It is actually a benefit for people that have to follow US tax law, as the penalties that the US Internal Revenue Service can impose on late taxes are severe. Anyone who lives in the US and trades cryptos needs to be well-educated in their tax responsibilities.

Occasionally, Coinbase may prompt users to upload some form of government-issued identification – this can be in the form of Driving License, Passport etc. It is recommended to verify your account with as much ID as you can this then increase your purchase limits, allowing you to buy more bitcoin with credit or debit card.

As time goes on, you will also find that your purchasing limits increase, for much larger orders ( in the thousands ) you will need to add your bank details and send a wire transfer.

Once the verification process is complete, users can navigate over to their profile and find an option to add payment methods to their account. Users can link their PayPal account, bank account, or debit/credit card. Keep in mind that purchases made directly through bank accounts take up to five days to get verified.

All the cryptocurrencies purchased through Coinbase are sent directly to your Coinbase wallet. The platform doesn’t charge any fees for the use of debit cards. However, it does charge a small fee of 3.7 percent per credit card transaction.

For further information, take a look at our full Coinbase review.

CoinMama

CoinMama is a large bitcoin brokerage that allows users to acquire coins with their debit or credit cards. It is based in Israel and has a global client base. The platform issues small fees for transactions. To make up for this, however, the limits for how many bitcoins a user can buy are much higher in comparison to Coinbase.

Users can acquire up to $5,000 of coins per day or up to $20,000 per month. All users need to do to use CoinMama is to set up an account, log in, and navigate to the profile page section to fill in personal information.

Following this, users will be introduced to a page that allows them to select how many bitcoins they would like to purchase, and once a fitting amount has been selected, users will be allowed to add their preferred payment methods and bitcoin addresses.

Users will also be required to verify their phone number and email address. CoinMama does not require most users to upload their government-issued ID. After completing the aforementioned steps and passing the verification process, users will be able to acquire bitcoins through CoinMama.

One of the things that sets CoinMama apart from other exchanges is its high purchase limits, and willingness to deal with just about anyone. It has very few restrictions on who can use the exchange, which is good news for people who don’t live in North America or the EU.

Coin Mama has a great looking platform that will allow its clients to trade in numerous major and minor cryptos. On the downside, it isn’t the cheapest exchange out there.

Some of the larger exchanges that allow the use of credit cards to purchase cryptos aren’t always going to be competitive with crypto only exchanges. Looking into your options for crypto-crypto trading could make sense if you plan on trading a lot.

Find out more in our full review.

BitPanda

BitPanda is a large and trusted bitcoin exchange platform based out of Austria. Its biggest drawback is that it only offers its services to residents of Europe. It is fully automated, which makes transactions fast and secure.

The platform also allows users to acquire Ethereum. BitPanda bares the same verification processes as the other major exchanges. However, the purchase limits for credit card transactions are over $2,000 a day, with up to $75,000 per month.

Other payment methods allow purchases of up to $10,000 per day or $300,000 per month. Transaction fees are also quite low, making BitPanda a great option to buy bitcoins with credit or debit cards for citizens of European countries.

BitPanda will allow you to hold GBP, USD, EUR, CHF, as well as 25 different cryptos in the same account. Being able to hold numerous fiat and cryptos in the same account is convenient, and could be useful for people that want a lot of flexibility when it comes to their asset structure.

If you plan on buying a lot of crypto at BitPanda, the exchange will probably want to know where the money is coming from. Austria has a heavily regulated banking system, and large amounts of money passing through your account will attract attention.

Overall BitPanda is worth considering if you want to buy a bunch of crypto with a credit or debit card, and live in the countries it serves. BitPanda also supports loads of other payment and withdraw options, like SEPA, Neteller and Skrill.

Read our Bitpanda review here.

CEX.IO

CEX.io is one of the world’s oldest bitcoin exchanges that operates in the United States, Europe, and certain South American countries.

CEX.io is wildly popular and quite well trusted by the cryptocurrency community. It was one of the most powerful forces in crypto mining for a short time, but today the company focuses on trading cryptos. It offers a range of services and levels of verification.

Trading fees on the platform are fairly low. However, the verification process is more extensive than on other exchanges. Occasionally, users may be prompted to upload a picture of themselves along with some form of government-issued ID. CEX.io operates under the same principles as most other popular bitcoin exchanges.

It is important to understand that CEX.io offers both a cryptocurrency brokerage service, and an exchange. The fees that CEX.io charges on its brokerage platform can be high, but the fees for trading cryptos with them are much lower.

There are also restrictions in place that prevent people from using CEX.io. Depending on where you live, you may or may not be able to use certain funding options, or use the platform at all.

If you are from one of the following countries, you can’t buy cryptos from CEX.io with a credit card:

Afghanistan, Algeria, Bahrain, Iraq, Kuwait, Lebanon, Libya, Nigeria, Oman, Pakistan, Palestine, Qatar, Saudi Arabia, Yemen, Iceland and Vietnam.

If you are from one of the following countries, you won’t be able to fund your account with a wire transfer:

Afghanistan, Democratic Republic of the Congo, Côte d’Ivoire, Eritrea, Ethiopia, São Tomé and Príncipe, Somalia, Sudan, Syria, Tanzania, Tunisia, Turkey, Vietnam, Yemen, Zimbabwe, Guinea-Bissau, Haiti, Iran, Iraq, Kenya, Liberia, Libya and Guinea.

Residents of the following US States will be denied an account at CEX.io:

Alabama, Alaska, Arizona, Colorado, Florida, Georgia, Guam, Idaho, Iowa, Kansas, Louisiana, Maryland, Michigan, Mississippi, Nebraska, New Hampshire, New Jersey, North Carolina, North Dakota, Ohio, Oregon, Tennessee, Texas, U.S. Virgin Islands, Vermont, Virginia, and Washington.

As long as you aren’t on those lists, you should be able to use any of the tools that CEX.io has. You will need to go though an extensive verification process to deal in larger amounts of cryptos, but that is becoming the norm at most exchanges that deal with fiat currency.

While we don’t have any direct experience with the customer service department at CEX.io, is has gained a reputation for being less than helpful. Be sure to dig into the information that is available online before deciding on a crypto exchange, so you are making an informed decision.

Full Review of CEX located here.

Changelly

Changelly is a cryptocurrency exchange which is associated with converting one type of currency to another. It also allows you to buy most of the major cryptos with a credit card, and have the cryptocurrency sent to your crypto wallet.

Its platform is really easy to use and offers a wide range of cryptocurrencies to choose from. They also offer purchasing of some currencies in USD and they accept payment via Mastercard or VISA so they provide an easy way to obtain bitcoin from your bank or credit card facilities.

Changelly is a very trusted exchange with a “Great” rating on TrustPilot, having been around for over 2 years now with no problems. Changelly is easy to signup for with just email verification required which means you can your chosen currency in your wallet fairly quickly.

The process of registering and buying cryptos from Changelly is straightforward, but you should have some sort of hardware or software wallet, and know how to send cryptos to it.

Changelly has connections with some of the biggest crypto exchanges operating today, like Bittrex and Poloniex. By having access to crypto market makers, Changelly offers its customers leading rates on purchases and exchange, as well as deep liquidity for big orders.

You will need to be able to verify your identity to use a credit or debit card with Changelly, but it may be as easy as entering a SMS code for smaller purchases after you supply basic personal information.

If you want to deal with an established crypto exchange that offers some of the best rates in the industry, it is worth checking out Changelly.

Our review of Changelly is here.

Crypto-Only Exchanges Could be Useful as Well

Once you own cryptos, there are a number of exchanges out there to choose from.

The following exchanges don’t offer direct purchase of cryptos with credit or debit cards (though that may change at any time, so check before you dismiss them outright), but they do offer great trading platforms and low rates on crypto trading.

One of the most important things to consider is what your goals in the crypto world are. Some people just want to grab a few tokens and hold onto them for the long term. If you are looking to make a long-term investment in cryptos, then buying a few with a credit or debit card and storing them on a secure wallet is fine.

The fees that you pay to buy and transfer cryptos won’t really matter in the grand scheme, as your expectation for price movements is far higher than a few percent. If you are looking to trade cryptos actively, then it is far more important to look into the fees that an exchange charges.

Crypto only exchanges can have extremely low rates, and some also offer token pairs that are difficult to find elsewhere.

Binance

Binance have grown rapidly into one of the world’s most used crypto exchanges. It was founded in China, but is now serving its clients from the crypto-wonderland of Malta.

One of the biggest selling points for Binance is the fact that it offers two kinds of trading platforms. It has a basic platform for people that are new to crypto trading, and an advanced platform for traders that need more functionality.

Like most crypto-only exchanges, there is little in the way of KYC for new clients that don’t need to trade in large amounts of cryptos. A level 1 account will get you a daily withdrawal limit of 2BTC, and a level 2 account will earn you a withdrawal limit of 100BTC.

A level 2 account will require photo ID, and there are higher withdrawal limits available for people that need one. If you need to move a lot of crypto through Binance just drop them a line, and they will let you know what you need to provide in terms of ID verification.

Binance’s fees are super low, and can also be discounted by using their token. If you want to learn more about the exchange, check out our review right here.

Note: If you are in the USA, you will need to register with Binance.US

Bittrex

Bittrex still doesn’t accept credit or debit cards, but it will allow you to deposit money in USD via a wire transfer. The exchange was founded in 2014 and is based in Seattle, Washington. It has definitely been in the top 10 global exchanges when it comes to daily turnover, and has a good reputation for customer service.

The great part about Bittrex is the sheer number of BTC pairs it supports. There are at least 450 BTC pairs on the exchange, and also some other options for people that want to trade in other major cryptos. While the company won’t allow its clients to use credit or debit cards, it does offer bank transfers at good rates.

One thing to keep in mind with Bittrex is that if you want to fund your account with fiat currency, there is a minimum deposit of $10,000. That amount might seem high to some people, and there are lots of other options out there if you need an exchange who will take a smaller amount of money to get started.

Bittrex was founded by a software engineer who worked at Amazon and Blackberry that specializes in data security. The exchange has a reputation for keeping its clients cryptos safe, and the trading platform it offers is on par with any of the other crypto exchanges on this list.

If you want to learn more about Bittrex, check out our full review here.

Poloniex

Poloniex has established itself as one of the foremost North American crypto exchanges. In addition to having a large daily turnover and deep liquidity, Poloniex was taken over by Circle, which is backed in part by investment bank Goldman Sachs.

While it is a great exchange that offers crypto traders a lot, Poloniex isn’t going to be right for everyone. It is strictly a crypto-only exchange that doesn’t deal with fiat currency at all. That means that you can only fund it with cryptos, not bank transfers or any kind of credit or debit card.

Poloniex does offer its clients Tether, which is a stablecoin that is tied to the US dollar. It isn’t a perfect system, and the value of Tether does vary from day to day. If fiat currency isn’t a concern, and you are happy to deal solely in cryptocurrencies, Poloniex is one of the best exchanges out there to learn more about.

On the plus side, Poloniex was the first crypto exchange to be regulated by the SEC and FINRA. The USA is one of the strictest countries when it comes to financial regulations, and that puts Poloniex a step above offshore exchanges that have far less regulatory oversight to deal with.

The trading platform that Poloniex offers its clients is geared toward experienced traders, and it might not be a perfect fit for everyone. Its fee structure is extremely competitive, and the exchange offers deep liquidity and a huge range of tokens.

If you would like to learn more about Poloniex, have a look at this in-depth review (LINK).

HADAX

HADAX is an interesting idea from Huobi. If cryptos are the wild west of the financial world, HADAX is the unknown frontier of the crypto wilderness. Huobi created the platform to allow the trade of smaller tokens, which can be extremely volatile.

If you are looking for an exchange to trade in major cryptocurrencies like BTC, ETH or XRP, HADAX probably isn’t the exchange for you. The platform was set up to allow its users to vote on which tokens should be listed via HT tokens, which makes the listing process both decentralized and autonomous.

HADAX doesn’t deal in fiat currency, and will only accept deposits in cryptos. On the plus side deposits are accepted with no charge, and the trading fees on the platform are low. If you are looking to get into some extremely speculative digital assets, HADAX could be worth a look.

Finding Other Exchanges

Before jumping on any exchange that you come across selling bitcoins and other cryptocurrencies, it’s vital that you do your due diligence pertaining to the platform. Make sure that the platform you are looking to use has a good and trusted reputation, and read reviews.

There are many scammers out there, as well as shady exchanges. It is not uncommon for unscrupulous bitcoin exchanges to steal their users’ credit card information and other sensitive data.

If you are looking for other options for the purchase of Bitcoin, you are in luck. There are many ways to get Bitcoin if you don’t want to share much of your personal data online, though you will need to jump though a few hoops to make the deal happen.

Feel Like Using Cash to Buy Bitcoin?

One of the biggest selling points for Bitcoin was its near total anonymity. Now that most exchanges where you can buy and trade cryptos are going to ask for some form of ID verification (especially if you want to buy your cryptos with fiat currency), it is much harder to get into Bitcoin without sharing personal information.

While it is nearly impossible to buy Bitcoins without leaving some sort of transactional evidence behind, there are options for people that want to buy cryptos with cash. Here are a few ways you can go right from cash into cryptocurrency, as long as you are willing to walk the path less traveled.

Buy at a Bitcoin ATM

Bitcoin ATMs have been installed in many places, especially in North America and the EU. While turning a bunch of cash into Bitcoin with crypto ATMs isn’t going to be easy, they can be used to purchase Bitcoin and other cryptos with relative anonymity.

The first major downside of buying Bitcoin in person is that most crypto ATMs have a limit on how much can be bought at one time. If you only want to pick up a few hundred dollars or euros worth of BTC or ETH they could be a good option, but stashing tens of thousands of dollars away on the sly with crypto ATMs isn’t going to be easy.

Additionally, there are almost certainly going to be people and cameras around wherever a crypto ATM is located. The people working at the store will probably remember that you show up every few days with a stack of cash to buy cryptos, or at the very least a security camera will keep a record of it.

While certainly not a perfect solution for everyone, Bitcoin ATMs are a viable options to turn your cash directly into cryptos. If there are a lot of them where you live, you might be able to do a few laps around the metro area and pick up an appreciable amount of crypto on the DL.

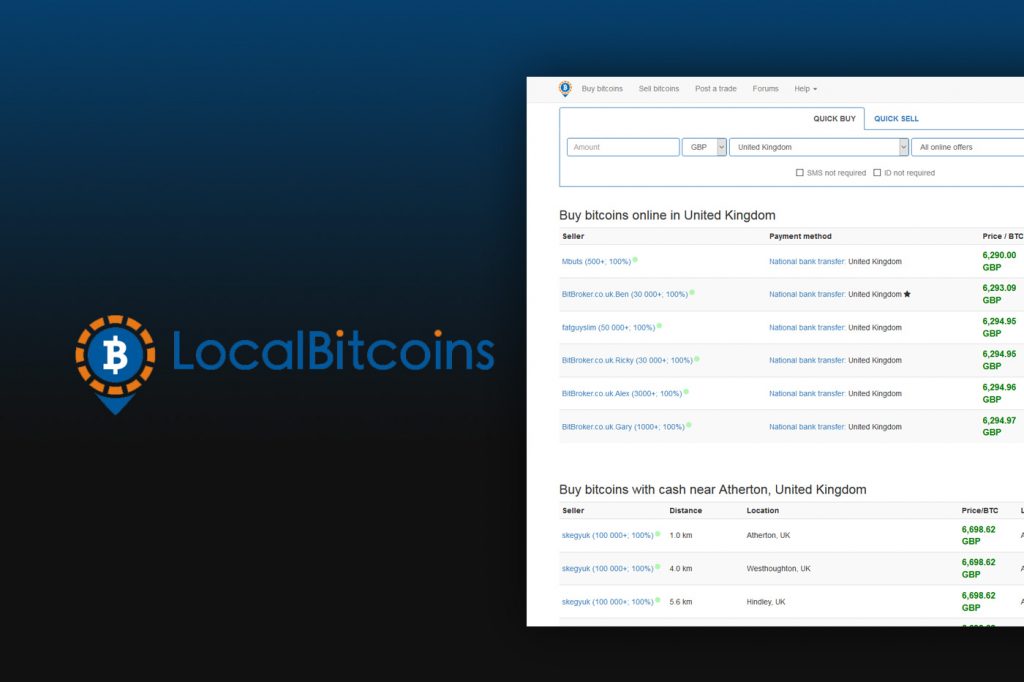

LocalBitcoins

LocalBitcoins is an interesting platform. Started in 2012 in Finland as an easy way for people to trade Bitcoin on a peer-to-peer (P2P) basis, it remains a great tool for people that want to bypass the cryptos exchanges.

The process of using LocalBitcoins is pretty simple. All you have to do is open an account, and provide some basic personal information. There are a number of ways to pay for the Bitcoins, including ‘cash in the mail’, which opens up a whole range of bartering options.

Remember, LocalBitcoins is a P2P exchange, so it is important to make sure and research the counterparty you are considering a trade with. Make sure they have done a lot of deals, and haven’t raised any red flags with previous clients.

The fees that LocalBitcoins charges are generally quite low, and are usually only applied to the person that took out the advert. On the flip side, the rate that Bitcoins are sold at on the platform tends to be above market rate, and the amount of liquidity if obviously much lower than a crypto exchange.

If you want to learn more about LocalBitcoins, check out our full review here.

Wrapping up – Final Thoughts

While there certainly are risks involved with purchasing bitcoins from exchanges using your bank cards, it’s also one of the easiest ways to acquire this cryptocurrency.

In fact, it is comparable to how regular shopping is done online. However, buying bitcoins with credit and debit cards usually entails high fees and can leave buyers exposed to risk. Fees for purchases made with bank accounts are generally lower.

Keep in mind that bitcoin purchases on exchanges with stolen credit or debit cards are impossible due to the verification processes that exchanges have put in place to protect buyers. Anonymous purchases of bitcoins are also impossible due to the verification processes.

Unfortunately, pre-loaded debit or credit cards don’t work on most popular exchanges. If you are in possession of a prepaid debit or credit card, you may have to refer to LocalBitcoins to purchase bitcoins.

Individuals should devote a lot of time to researching exchanges and platforms before buying any bitcoins. Due to the verification processes implemented on most, it would be truly terrible to have your personal information or government ID fall into the hands of some scammers or shady platform.

It’s also highly recommended that users transfer their bitcoins from exchange platforms directly to their personal bitcoin wallets to keep acquired assets safe from theft.

Keep in mind that you aren’t limited to using one exchange. This means you can own accounts on all of the reputable exchanges, like Coinbase, BitPanda, CoinMama, LocalBitcoins, CEX.io and Changelly. This is perfect for users who feel restricted by exchange platform transaction limits.

1 Comment

Can I purchase Bitcoin and have it sent to Lagos Nigeria, by using it threw my bank account and or a debit card.

I have to have 9500$ sent there by December time frame and I will be sending 130o each month.

Lonnie Chapman Sgt/USMC