Bitcoin mining revenue is down by almost 50% from its pre-halving level with hash rate also showing a similar decline.

The halving event which saw block rewards cut in half appears to be significantly impacting the bottom-line for miners especially as a new difficulty adjustment is yet to happen.

Meanwhile, transaction fees are now accounting for a significant portion of the revenue earned by Bitcoin miners, reaching levels not seen since 2018

On the price side, BTC appears to be caught in a sideways accumulation phase between $9,500 and $9,800, signaling a massive resistance at the $10k to $10.1k level.

Bitcoin Mining Revenue and Hash Rate Tumble

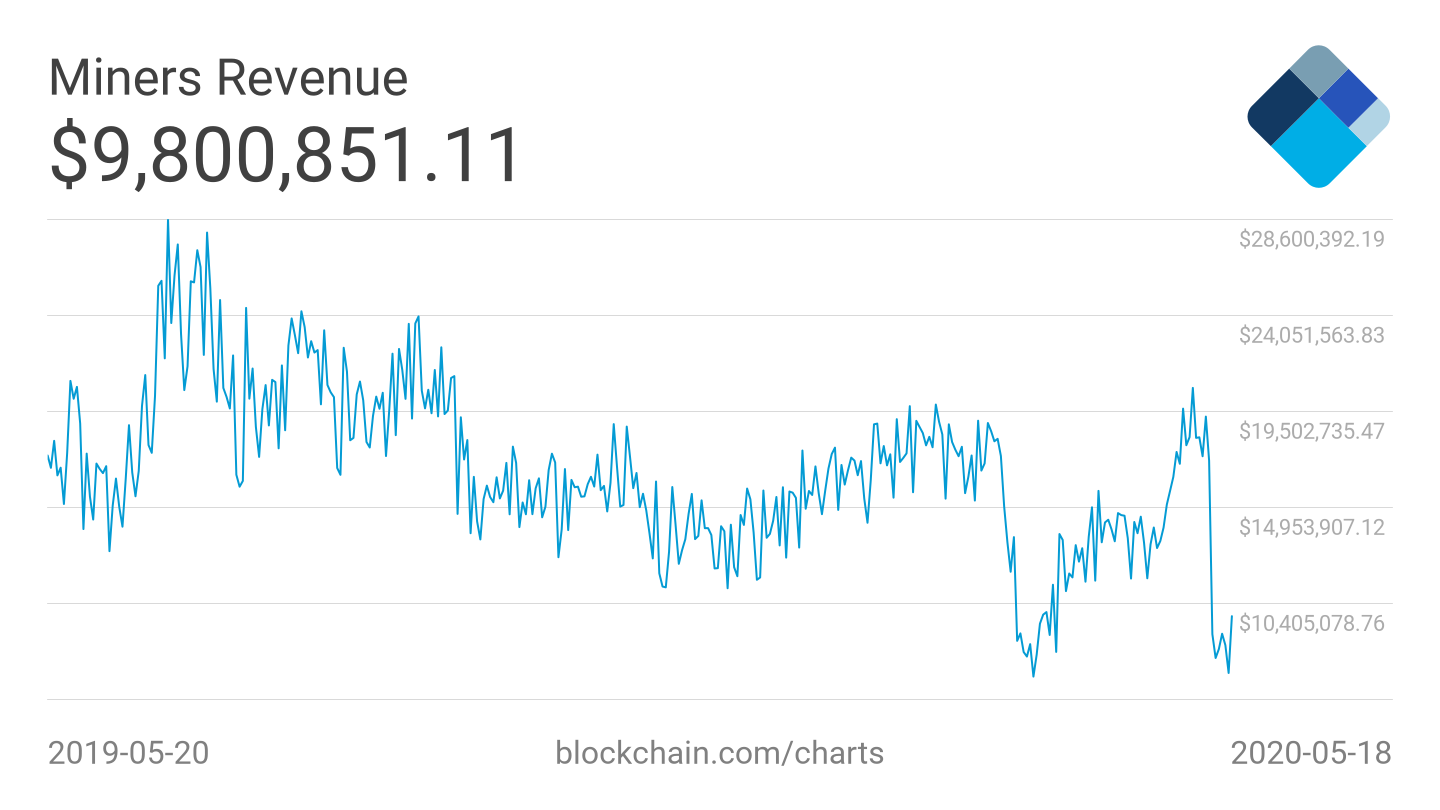

According to data from Blockchain.com, Bitcoin mining revenue in USD has fallen by about 50% since the halving event took place a few days ago. The halving which reduces block rewards by half means a decrease in the inflation causing daily BTC supply to go down from 1,800 BTC to 900 BTC.

With the daily supply reducing by half, mining nodes are having to compete for fewer available new BTC. Many of these Bitcoin mining operations have recently installed state-of-the-art hardware to boost their chances of beating the rest of the competition.

The network hash rate — the computing power expended to secure the network — is also on the decline. Inefficient miners not able to compete are shutting down their machines and exiting the network.

The exodus of a significant amount of hashing power creates a shortfall in the computing power expended on the network. Again, the emergence of a decline in hash rate post-halving is not surprising.

Once the next downward difficulty adjustment occurs, the effect of the current miner exodus should be mitigated. Bitcoin has historically recovered from hash rate plunges even those incorrectly characterized as mining death spirals and there is little evidence to suggest the current situation will be any different.

Fees Now Accounting for 15% of Miner Revenue

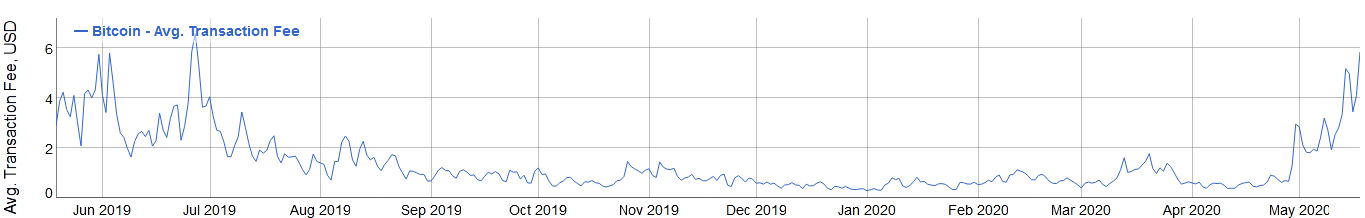

Meanwhile, transaction fees now account for more than 15% of Bitcoin mining revenue, according to data from crypto analytics provider Glassnode. Not since the ‘crypto-mania’ hype of late 2017 and early 2018 have fees represented such a significant portion of the BTC miner earnings.

The increase in Miner revenue from fees comes amid a continuing rise in Bitcoin transaction fees. BTC fees are currently at their highest level in almost a year with BitInfoCharts showing transaction costs averaging $5.83.

With the increasing level of on-chain activity coupled with the reduction in block rewards, miners are prioritizing transactions with higher fees. Thus, the mempool is experiencing a growing backlog of unconfirmed transactions with significantly lower fees.

While the current fee hike is considerable, it is little compared to the spike seen in 2017 when transaction costs went as high as $50. The introduction of SegWit has helped to prevent the occurrence of such massive fees and once the next downward difficulty adjustment occurs, the mining space will regularize leading to a decrease in transaction costs.

Will Price Follow?

While the Bitcoin appears caught in a sideways accumulation trend, some crypto pundits argue that the BTC price will soon follow hash rate and miner revenue in experiencing a decline. Since falling to $3,800 during Black Thursday — March 12, 2020 — the top-ranked cryptocurrency by market capitalization has recovered, even temporarily going above the $10,000 mark in late April.

Typically, the Bitcoin price has set a new all-time high in the year immediately following a halving event. On-chain data shows increasing accumulation across both the retail and institutional market segments with investors looking to ride another upward price growth for BTC.