TLDR

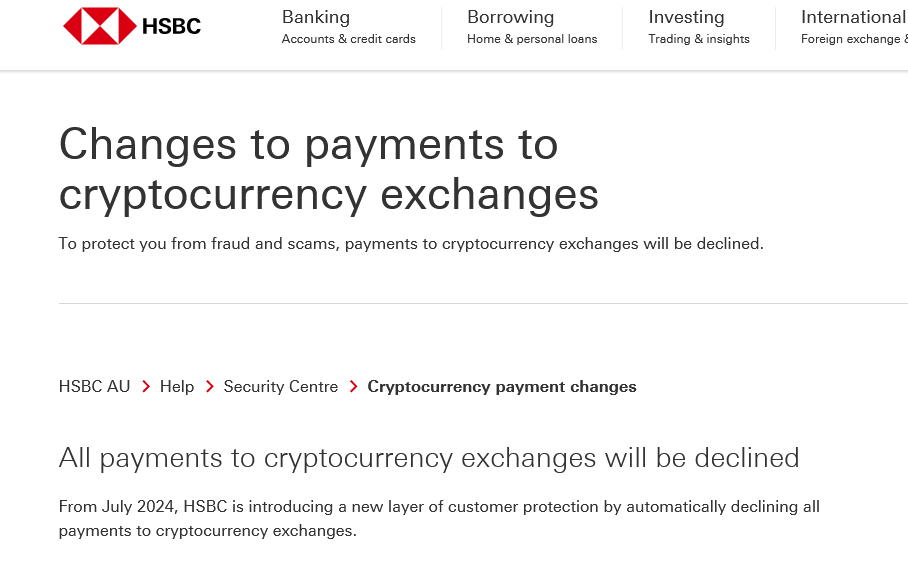

- HSBC Australia is blocking customer payments to crypto exchanges starting July 24, 2024.

- The bank cites rising concerns over crypto-related investment scams as the reason for this action.

- At least six major Australian banks have taken similar measures to restrict crypto transactions.

- HSBC will still allow customers to receive payments from crypto exchanges.

- Australian regulatory bodies are increasing scrutiny of the cryptocurrency sector.

In a move that reflects growing concerns about cryptocurrency-related scams, HSBC Australia has announced it will block all customer payments to crypto exchanges starting July 24, 2024.

This decision makes HSBC the latest in a line of major Australian banks to restrict crypto transactions, citing customer protection as the primary motivation.

HSBC Australia, which serves 1.5 million customers across 45 branches, informed its clients via email about the upcoming changes. The bank pointed to data from Australia’s competition and consumer regulator, which reported that Australians lost up to $171 million in investment scams in 2023.

While HSBC will prevent outgoing payments to crypto exchanges, it will continue to accept incoming transfers from these platforms.

This action by HSBC is not isolated. At least six major Australian banks have implemented similar restrictions over the past year. The Commonwealth Bank, National Australia Bank, Westpac, and Australia and New Zealand Banking Group have all taken steps to limit access to cryptocurrency platforms.

Bendigo Bank quickly followed HSBC’s lead, also citing the need to protect customers from investment scams.

The trend has raised concerns within the cryptocurrency industry. Amy-Rose Goodey, managing director of the Digital Economy Council of Australia (DECA), expressed worry about the impact on Australians’ “financial rights” to participate in the digital economy.

Goodey emphasized the need for dialogue and improved regulatory frameworks to support innovation while effectively addressing potential risks.

These banking restrictions come amid increased scrutiny of the cryptocurrency sector by Australian regulatory bodies. AUSTRAC, Australia’s financial crime watchdog, has recently intensified its warnings about the potential for money laundering through cryptocurrencies.

The agency noted particular vulnerabilities with digital currencies being used for payments and predicted increasing risks in this area.

Other regulatory actions include a prohibition on using cryptocurrencies for online gambling payments in Australia. The Australian Taxation Office is seeking personal information and transaction details from crypto investors and exchanges.

Meanwhile, the Australian Securities and Investments Commission (ASIC) is targeting crypto entities suspected of offering unregistered securities.

The banking sector’s approach to cryptocurrency transactions highlights the ongoing challenges in balancing innovation with consumer protection.

While banks argue that these measures are necessary to safeguard customers from scams, critics worry that such restrictions may hinder the growth and adoption of digital currencies in Australia.